The Only Guide to Tax Accountant In Vancouver, Bc

Table of ContentsThe Greatest Guide To Cfo Company VancouverAll About Tax Consultant VancouverSome Ideas on Cfo Company Vancouver You Should KnowFacts About Virtual Cfo In Vancouver UncoveredThe 10-Minute Rule for Vancouver Accounting FirmSmall Business Accounting Service In Vancouver - The Facts

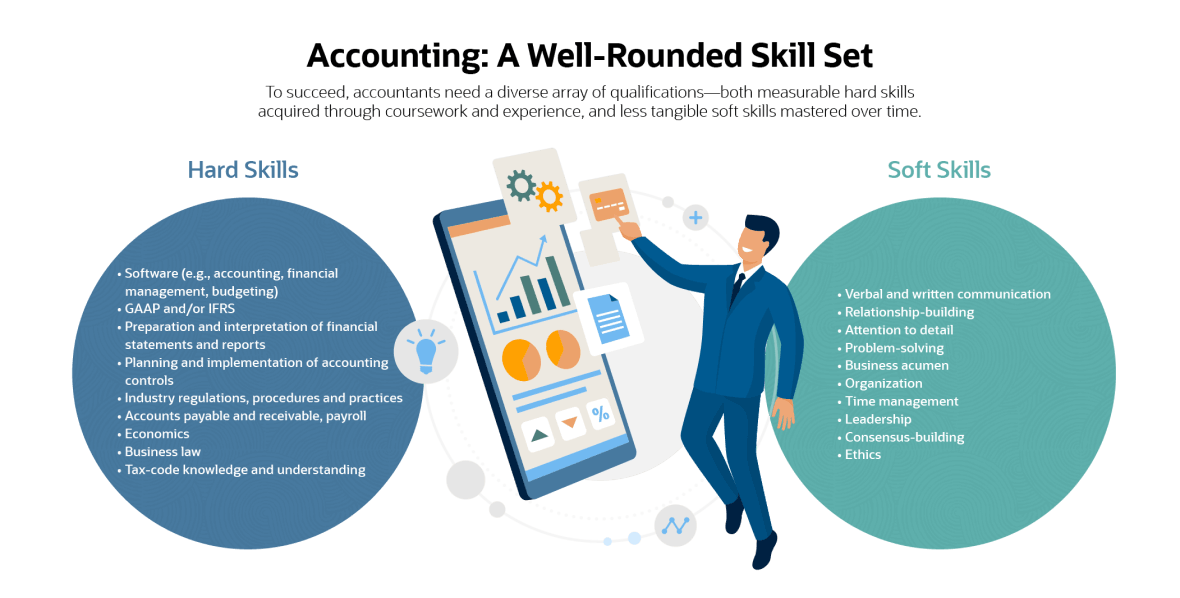

Below are some benefits to hiring an accountant over an accountant: An accounting professional can offer you an extensive sight of your company's financial state, along with strategies and recommendations for making economic decisions. Bookkeepers are only responsible for videotaping monetary deals. Accountants are called for to complete more schooling, accreditations as well as work experience than bookkeepers.

It can be tough to evaluate the appropriate time to hire a bookkeeping expert or bookkeeper or to figure out if you need one whatsoever. While many small companies hire an accountant as a specialist, you have several alternatives for handling financial tasks. Some tiny organization owners do their very own bookkeeping on software their accountant advises or uses, providing it to the accountant on a weekly, regular monthly or quarterly basis for action.

It may take some history research study to discover a suitable accountant because, unlike accountants, they are not required to hold a professional certification. A solid recommendation from a trusted colleague or years of experience are essential factors when hiring a bookkeeper.

5 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In Vancouver

For little businesses, experienced cash management is a critical aspect of survival as well as development, so it's a good idea to function with a monetary specialist from the beginning. If you favor to go it alone, think about beginning with accounting software program as well as maintaining your books meticulously up to day. This way, should you need to employ a specialist down the line, they will have visibility into the full economic history of your business.

Some resource interviews were conducted for a previous version of this write-up.

Cfo Company Vancouver Things To Know Before You Buy

When it pertains to the ins and also outs of taxes, accounting and money, nonetheless, it never harms to have a seasoned expert to turn to for guidance. A growing variety of accounting professionals are likewise dealing with points such as capital projections, invoicing and human resources. Inevitably, several of them are taking on CFO-like functions.

For instance, when it involved looking for Covid-19-related governmental financing, our 2020 State of Small Company Research located that 73% of small company owners with an accounting professional claimed their accountant's advice was necessary in the application process. Accounting professionals can also aid entrepreneur avoid costly mistakes. A Clutch survey of small company owners programs that greater than one-third of small companies checklist unanticipated costs as their leading economic challenge, adhered to by the blending of company as well as individual financial resources and the failure to receive repayments promptly. Local business owners can anticipate their accountants to aid with: Selecting the organization framework that's right for you is essential. It affects just how much you pay in taxes, the paperwork you require to file and your from this source individual liability. If you're looking to transform to a various organization framework, it can lead to tax obligation repercussions and other problems.

Even companies that are the very same size and also industry pay extremely different amounts for accounting. These expenses do not convert right into cash, they are necessary for running your business.

The Main Principles Of Tax Accountant In Vancouver, Bc

The typical expense of audit services for small company varies for each distinct scenario. Because bookkeepers do less-involved tasks, their rates are often less expensive than accountants. Your monetary solution cost relies on the job you need to be done. The ordinary month-to-month audit fees for a small company will certainly rise as you include much more services and the tasks get tougher.

You can tape deals and process payroll utilizing online software. Software services come in all shapes and dimensions.

The 5-Minute Rule for Pivot Advantage Accounting And Advisory Inc. In Vancouver

If you're a new entrepreneur, don't fail to remember to element accounting expenses into your spending plan. If you're a veteran proprietor, it might be time to re-evaluate bookkeeping prices. Administrative expenses and also accountant fees aren't the only accountancy costs. Vancouver accounting firm. You need to likewise think about the results bookkeeping will certainly have on you as well as your time.

Your capacity to lead workers, serve consumers, as well as make decisions could experience. Your time is additionally useful as well as should be taken into consideration when considering bookkeeping expenses. The time invested on audit tasks does not produce profit. The less time you spend on accounting and taxes, the even more time you need to expand your organization.

This is not intended as lawful suggestions; for more info, please go here..

Cfo Company Vancouver Can Be Fun For Everyone